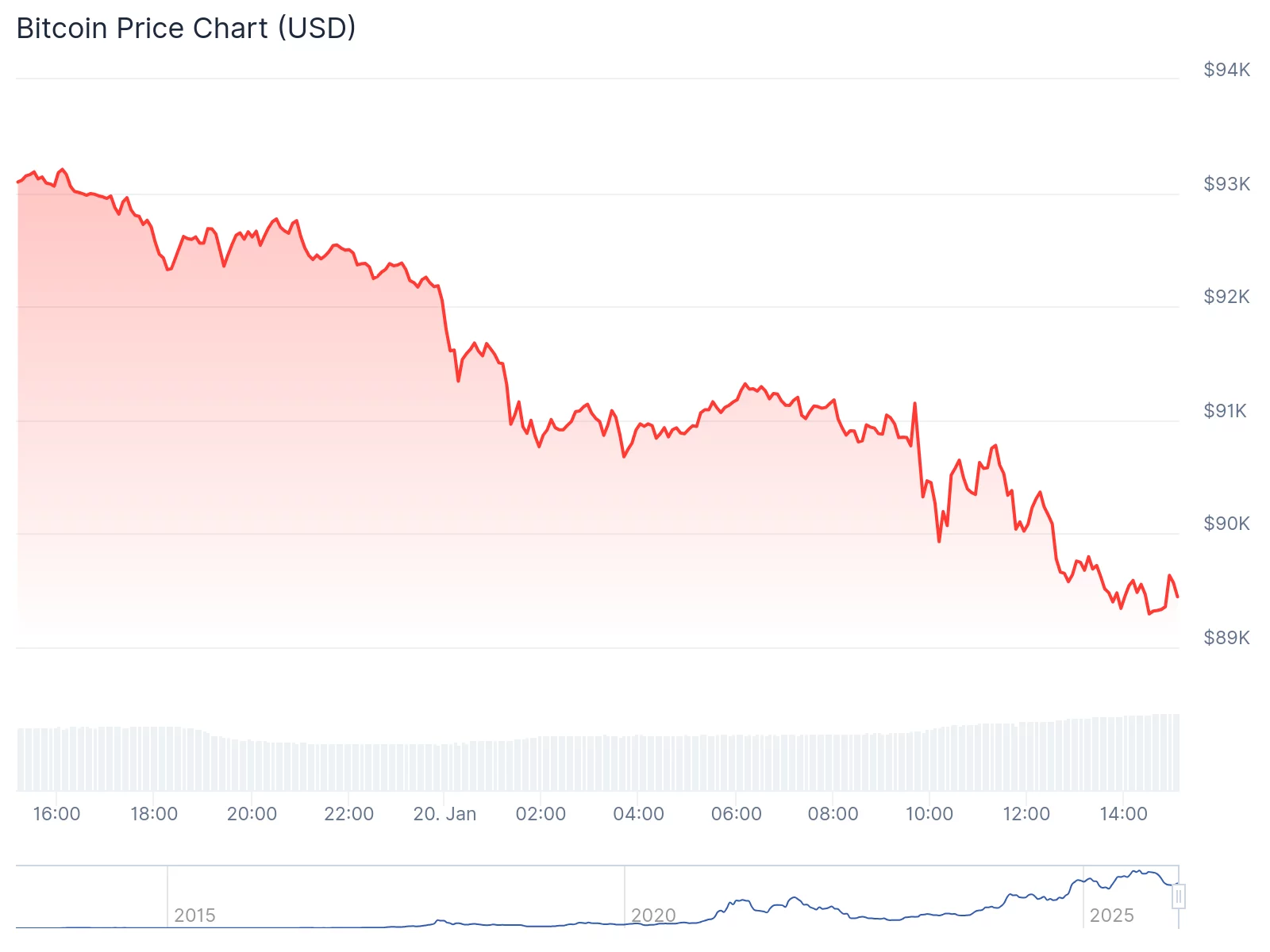

Bitcoin slid below $90,000 for the first time in more than a week, extending losses alongside a sharp global market selloff as investors pulled back from risk amid mounting geopolitical tensions and turmoil in bond markets.

Summary

- The world’s largest cryptocurrency fell as volatility swept across equities, long-dated U.S. Treasuries and Japanese government bonds.

- The downward trajectory underscores Bitcoin’s continued sensitivity to macro shocks rather than its “digital gold” narrative.

- Trump doesn’t feel the sting, having raked in an estimated $1.4 billion since his second term began.

Bitcoin dropped 3.9% to about $89,417 by about 3 p.m. in New York, its lowest level since Jan. 9. Losses were steeper across smaller tokens, with Ether tumbling more than 7% and Solana down 5.3%. Crypto-linked equities also came under pressure, with Coinbase Global Inc. falling more than 5% and Bitcoin-heavy Strategy Inc. sliding nearly 10%.

The selloff unfolded as broader financial markets reeled after President Donald Trump’s latest foreign policy remarks, which revived fears of a fractured transatlantic alliance, as he reiterated plans to assert U.S. control over Greenland. The comments added to the already fragile sentiment across global markets, Bloomberg reported.

Bond markets were also rattled, particularly in Japan, where yields on 30- and 40-year government bonds surged more than 25 basis points. The move followed comments from Prime Minister Sanae Takaichi pledging tax cuts as part of her election campaign, fueling concerns over looser fiscal policy and higher government spending.

Despite the downturn, Strategy, led by Bitcoin bull Michael Saylor, disclosed Tuesday that it purchased nearly $2.13 billion worth of Bitcoin over the past eight days—its largest accumulation since July—offering a rare note of institutional support.

Still, on-chain data suggests momentum is cooling. CoinGlass’ net realized profit and loss metric has slipped slightly into negative territory after months of strong gains, a signal that buying pressure is fading as the market digests selling. While that doesn’t point to an imminent collapse, it leaves Bitcoin more vulnerable without fresh inflows.

Technically, traders are watching whether Bitcoin can reclaim the $97,000–$98,000 range, which would suggest bulls are regaining control. On the downside, a sustained break below $90,000–$91,000 could open the door to a deeper pullback, with some analysts eyeing levels as low as $62,000.

For now, Bitcoin’s outlook remains clouded, caught between weakening technical signals and lingering macro uncertainty—setting the stage for a volatile battle over its next move.

Trump profits despite volatility

Meanwhile, the Trump family’s crypto ventures have become a central pillar of its fortune, with an estimated $1.4 billion generated since January 20, 2025.

Each project, such as World Liberty Financial, has been bolstered by the Trump administration’s pro-crypto legislation and regulatory rollbacks, according to a Bloomberg analysis.