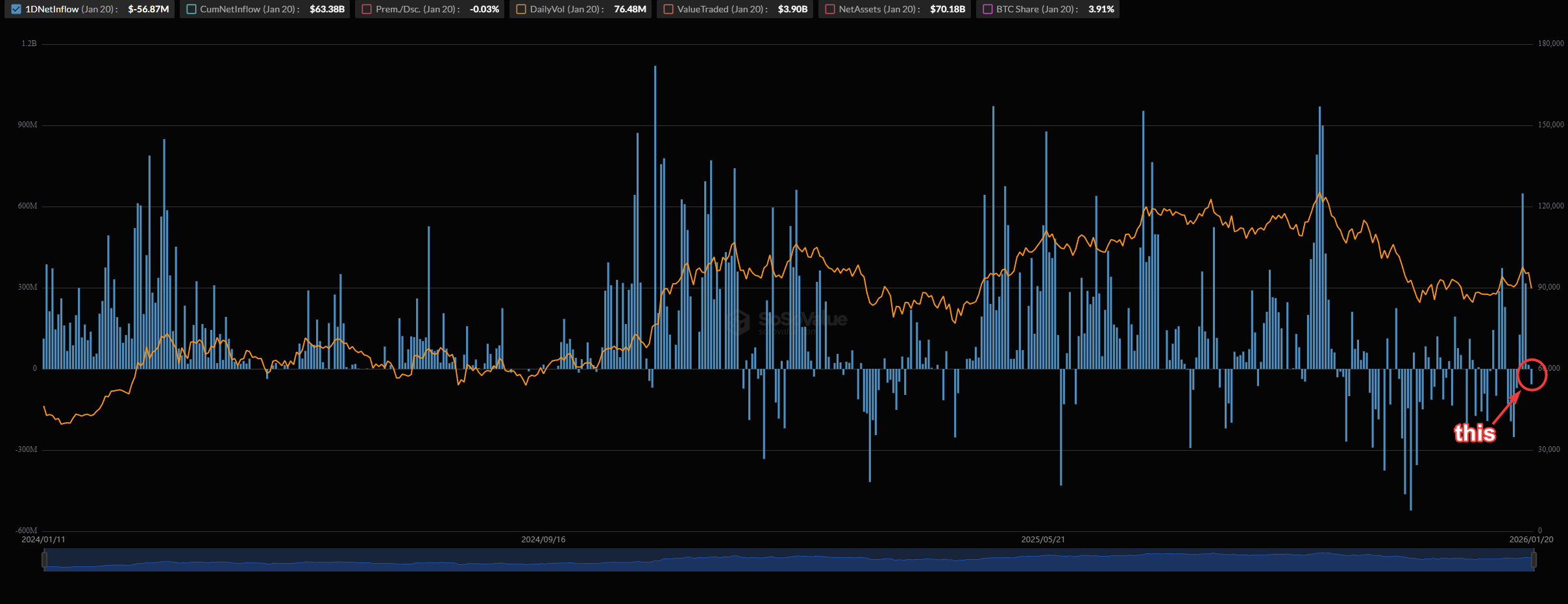

No, really, it’s over this time. This week BlackRock sold nearly $60M in

.cwp-coin-chart svg path {

stroke-width: 0.65 !important;

}

.cwp-coin-widget-container .cwp-graph-container.positive svg path:nth-of-type(2) {

stroke: #008868 !important;

}

.cwp-coin-widget-container .cwp-coin-trend.positive {

color: #008868 !important;

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.positive {

border: 1px solid #008868;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.positive::before {

border-bottom: 4px solid #008868 !important;

}

.cwp-coin-widget-container .cwp-coin-price-holder .cwp-coin-trend-holder .cwp-trend {

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-graph-container.negative svg path:nth-of-type(2) {

stroke: #A90C0C !important;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.negative {

border: 1px solid #A90C0C;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.negative {

color: #A90C0C !important;

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-coin-trend.negative::before {

border-top: 4px solid #A90C0C !important;

}

0.79%

Bitcoin

BTC

Price

$89,024.16

0.79% /24h

Volume in 24h

$35.73B

<!–

?

–>

Price 7d

// Make SVG responsive

jQuery(document).ready(function($) {

var svg = $(‘.cwp-graph-container svg’).last();

if (svg.length) {

var originalWidth = svg.attr(‘width’) || ‘160’;

var originalHeight = svg.attr(‘height’) || ’40’;

if (!svg.attr(‘viewBox’)) {

svg.attr(‘viewBox’, ‘0 0 ‘ + originalWidth + ‘ ‘ + originalHeight);

}

svg.removeAttr(‘width’).removeAttr(‘height’);

svg.css({‘width’: ‘100%’, ‘height’: ‘100%’});

svg.attr(‘preserveAspectRatio’, ‘xMidYMid meet’);

}

});

on behalf of their clients.

Typically, BlackRock’s wealthy clientele invests their money to earn yield. Those clients saw that Bitcoin was outperformed by every other asset in 2025 and said screw it.

Crypto Twitter did what it does best this week: panic first, verify later. A viral post following the BlackRock sell event from Ash Crypto claimed BlackRock had just sold hundreds of millions in Bitcoin and Ether, framing the move as fresh institutional capitulation.

“BTC to 1k end of Feb,” were some claims.

Right now, the mood on crypto Twitter is constant fatigue with the crypto ETFs, institutional plays, and Donald Trump’s erratic behavior towards the market. Here’s what you should know:

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2026

BlackRock Stock Dump: The Numbers Are Old, The Fear Is New

–>

Crypto Fear and Greed Index

Fear

<!–

<!–

–>

Extreme

Fear

Fear

Neutral

Greed

Extreme

Greed

<!—->

The figures cited, roughly $354 Mn in BTC and $247 Mn in ETH, trace back to ETF outflows recorded in November 2025. Those flows appeared in Arkham and ETF dashboards during a temporary rebalancing window. They were not new January 2026 liquidations, according to 99Bitcoins analysis.

Current ETF trackers show no comparable selloff. BlackRock’s iShares Bitcoin Trust still holds tens of billions in BTC on behalf of clients.

Ether exposure has barely budged relative to late 2025. This was recycled data repackaged as breaking news, and it worked because markets were already on edge.

DISCOVER: Top 20 Crypto to Buy in 2026

What Does The Chain and ETF Flows Actually Show For Crypto?

What did happen this week was heavy ETF plumbing. Wallets tied to BlackRock’s spot Bitcoin and

.cwp-coin-chart svg path {

stroke-width: 0.65 !important;

}

.cwp-coin-widget-container .cwp-graph-container.positive svg path:nth-of-type(2) {

stroke: #008868 !important;

}

.cwp-coin-widget-container .cwp-coin-trend.positive {

color: #008868 !important;

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.positive {

border: 1px solid #008868;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.positive::before {

border-bottom: 4px solid #008868 !important;

}

.cwp-coin-widget-container .cwp-coin-price-holder .cwp-coin-trend-holder .cwp-trend {

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-graph-container.negative svg path:nth-of-type(2) {

stroke: #A90C0C !important;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.negative {

border: 1px solid #A90C0C;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.negative {

color: #A90C0C !important;

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-coin-trend.negative::before {

border-top: 4px solid #A90C0C !important;

}

1.23%

Ethereum

ETH

Price

$2,941.84

1.23% /24h

Volume in 24h

$20.83B

<!–

?

–>

Price 7d

// Make SVG responsive

jQuery(document).ready(function($) {

var svg = $(‘.cwp-graph-container svg’).last();

if (svg.length) {

var originalWidth = svg.attr(‘width’) || ‘160’;

var originalHeight = svg.attr(‘height’) || ’40’;

if (!svg.attr(‘viewBox’)) {

svg.attr(‘viewBox’, ‘0 0 ‘ + originalWidth + ‘ ‘ + originalHeight);

}

svg.removeAttr(‘width’).removeAttr(‘height’);

svg.css({‘width’: ‘100%’, ‘height’: ‘100%’});

svg.attr(‘preserveAspectRatio’, ‘xMidYMid meet’);

}

});

ETFs routed over $430 Mn in crypto to Coinbase Prime, according to Arkham. That coincided with large US ETF outflows:

- Spot Bitcoin ETFs: roughly $709 Mn in net outflows

- Spot Ether ETFs: roughly $298 Mn in net outflows

Those transfers represent redemptions and settlement flows handled by authorized participants, not discretionary dumping. Still, they matter for short-term price action as we could be witnessing a catalyst for a massive dump in Bitcoin.

DISCOVER: 20+ Next Crypto to Explode in 2026

According to CoinGecko, Bitcoin hovered near $90,000 while Ether stabilized around $3,000 after the scare. Glassnode data shows no spike in long-term holder distribution. Meanwhile, DeFi Llama reports stable TVL, suggesting capital rotation rather than flight.

Just days before the panic, spot Bitcoin ETFs logged nearly $844 Mn in net inflows. That context never made it into the viral screenshots, yet it doesn’t hide the fact that investors feel hopeless about this market.

Crypto was better before governments got involved

— Benjamin Cowen (@intocryptoverse) January 21, 2026

Maybe BTC is just an MMO? You make friends and enjoy but eventually it comes to an end. At least that’s how it feels in moments like this; others, like us, see it as good times to dollar cost average into dips for good projects.

This episode is a reminder that crypto remains hypersensitive to institutional narratives, especially anything involving BlackRock.

Operational flows are not exits. But when fear is already in the air, even routine ETF mechanics can shake price.

EXPLORE: King of The Decade? Analyst says Bitcoin Price Returns Will Beat Gold and Silver

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis

Key Takeaways

- BlackRock Stock’s clientele invests their money to earn yield. Those clients saw that Bitcoin was outperformed by every other asset in 2025.

- Maybe BTC is just an MMO? You make friends and enjoy but eventually it comes to an end.

The post BlackRock BTC USD “Dump” Triggers Panic, ETF Plumbing Still Moves Markets appeared first on 99Bitcoins.