Bitcoin, Ethereum, and XRP, and most major crypto coins are dropping in price as the USD is taking a hit with rumors of Japanese Yen intervention and another US Government shutdown by the end of the month. Bitcoin dumped even more from last week to the 88,000 area, while Ethereum dumped by 1,4% and XRP fell further to the 2 USD mark.

People are speculating that the Fed could quietly follow Japan’s playbook and support the yen by selling dollars; the USD weakens by implication. What comes next usually follows with assets priced in dollars, these include Bitcoin, Ethereum, XRP, and most big crypto coins like Solana.

BREAKING:

As reported by the Financial Times, it appears that the NY Federal Reserve desk conducted rate check(s) on Friday in an effort to weaken the dollar/strengthen the Yen

This is incredibly rare, and signals that a LOT more dollar weakness might be ahead of us https://t.co/OgVz6B1bto pic.twitter.com/jeJOgl4o2H

— Milo (@milocredit) January 24, 2026

Bitcoin Price Falls as USD Weakens?

Bitcoin USD price is pinned under $88,000, testing support after a rough stretch of ETF outflows. US spot Bitcoin ETFs saw a healthy sum of outflows by the end of last week, and leverage liquidation hit $1.8 billion in liquidations over the past 2 days. As usual, institutional money does not tiptoe when it leaves.

Unexpectedly, GameStop transferred 4,710 Bitcoin, or about 422 million USD, to Coinbase Prime. Whether this will lead to a sale or a treasury reshuffle is still unclear, but it just doesn’t look good at all.

GameStop Moved 4.7K BTC to Coinbase Prime at $76M Loss

• GameStop, the world’s largest video game retailer, is seeing huge losses on its Bitcoin holdings as the leading asset struggles below $90,000.

• In May 2025, GameStop accumulated 4,710 BTC for roughly $504 million,… pic.twitter.com/R1yI24T6zy— D (@DateeD1) January 24, 2026

Price-wise, Bitcoin USD continues to echo older patterns seen against gold and even the NASDAQ. Gold just tagged $5,000 per ounce for the first time, silver crossed $100, and copper pushed to $5.92. Meanwhile, the total crypto market cap slid to a critical point of $3.04 trillion, erasing 150 billion in a short time span. However, historically, Bitcoin’s bear phases versus gold last around 14 months; the current drawdown sits near 51 percent over 350 days. Since the 2022 low, Bitcoin has tended to fall, go quiet for seven or eight weeks, then climb again. It is annoying, but time will tell.

DISCOVER: 10+ Next Crypto to 100X In 2026

Ethereum Price Slides, as ETH Foundation Spends 2 Million USD for Insurance

Ethereum price is holding support between 2,700 and 2,800 USD, with RSI hovering near oversold levels around 37. Bitcoin dominance remains high at under 60%, keeping altcoins on a short leash. Even so, Ethereum on-chain activity hasn’t cracked, as its price experienced a 10% dump this week.

Technically, ETH is consolidating below its 50-day EMA at $3,150 range, which caps upside for now. Still, oversold conditions often precede bounces toward 3,000, especially if Bitcoin USD stabilizes.

On the development side, the Ethereum Foundation launched a post-quantum security team with 2 million in funding, focusing on insurance and fondation, which is good for the years to comes.

Today marks an inflection in the Ethereum Foundation's long-term quantum strategy.

We've formed a new Post Quantum (PQ) team, led by the brilliant Thomas Coratger (@tcoratger). Joining him is Emile, one of the world-class talents behind leanVM. leanVM is the cryptographic…

— Justin Drake (@drakefjustin) January 23, 2026

XRP USD Rangebound as We Wait for Price Catalyst

The XRP price continues to respect a wide range that’s lasted nearly 400 days. The XRP USD price has oscillated between $1.8 and $3.6, a very wide 2x confusing range. Buyers who entered between $2 and $3 have endured drawdowns of 25 to 30 percent, and some suspect market makers could force a deeper flush before momentum backs, and are also very dependent on Bitcoin.

Macro forces loom large here, too. If the Fed does weaken the dollar by effectively creating dollars to buy Yen, USD devaluation could inflate risk assets across the board. In 2024, similar volatility preceded sharp BTC rallies, dragging the Ethereum and XRP price along for the ride.

It might be scary, but Big Four firm says crypto has crossed an irreversible point, and CZ Binance says the supercycle is coming this year.

DISCOVER:

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

Ethereum Preps for Quantum Threat With $1M Security Push

The quantum threat might be closer than we think, and Ethereum’s core developers just made a long-term security move that most investors never think about until it’s too late. The Ethereum Foundation has stood up a dedicated Post-Quantum (PQ) security team, backed by significant funding, including two $1 million research prizes.

One focused on hardening the Poseidon hash function (the “Poseidon Prize“), used heavily in zero-knowledge proofs, and another broader post-quantum effort was announced previously.

The team is taking the quantum risk seriously and upgrading the blockchain security as Ethereum is pushing deeper into finance, apps, and tokenised assets, while governments and institutions start asking harder questions about long-term safety.

The Ethereum Foundation is prioritizing post-quantum security.

Good. Quantum-resistant tech is crucial for ETH’s long-term survival.

— H2 finance (@H2_Finance) January 24, 2026

Read more here.

Circle Temporarily Flips BlackRock in Tokenized Treasuries Race

If you have ever sent or received USDC or USDT, then that, right there, is interacting with tokenized products. Stablecoins are a big success, and the first platforms to see this “future” are now making big money. Tether alone makes double-digit billions in profits while being very lean.

In early 2024, Larry Fink of BlackRock said the future will be tokenized. And around that time, the asset manager began tokenizing US treasuries on Ethereum. At the moment, billions worth of treasuries have not only been tokenized but are being used as collateral in DeFi protocols.

Given this trajectory, it is no surprise that the competition to capture the hundreds of millions in Treasury assets is cutthroat. Recent data shows that Circle temporarily flipped BlackRock as the largest Treasury tokenization vehicle in the world.

Read more about it here.

Coinbase Survey Says Bitcoin Is Undervalued as Price Slips Below $90K

Over 70% of institutional investors say Bitcoin is undervalued, according to a new Coinbase survey released this week. The gap between price action and big-money conviction is growing as global markets turn cautious on BTC USD and the broader crypto market.

This caution is evidenced by the Fear and Greed Index sitting at 20 (extreme fear), while this time last week it was at 44 (fear), just on the cusp of moving toward greed, but growing macroeconomic tensions continue to rule the charts.

1/2 Investors are bullish on bitcoin. And institutions are leading the charge.

While our December survey shows broad-based optimism for BTC, there is a clear sentiment gap: 71% of institutions believe BTC is undervalued, compared to 60% of non-institutions.

Has crypto matured… pic.twitter.com/vL6N5IWznv

— Coinbase Institutional

(@CoinbaseInsto) January 22, 2026

This Coinbase survey regarding whether Bitcoin is overvalued, fairly valued, or undervalued comes as the combined crypto market cap slipped a further -0.9% overnight, into Monday morning.

Right now, the crypto market cap is sitting at $3.051 trillion, getting closer to the key $3 trillion level, which, if lost, could signal further downside on the charts. The Coinbase Bitcoin survey makes for positive reading, but hasn’t stopped BTC USD losing $88,000 overnight, where it currently trades for $87,800.

Read our full coverage here.

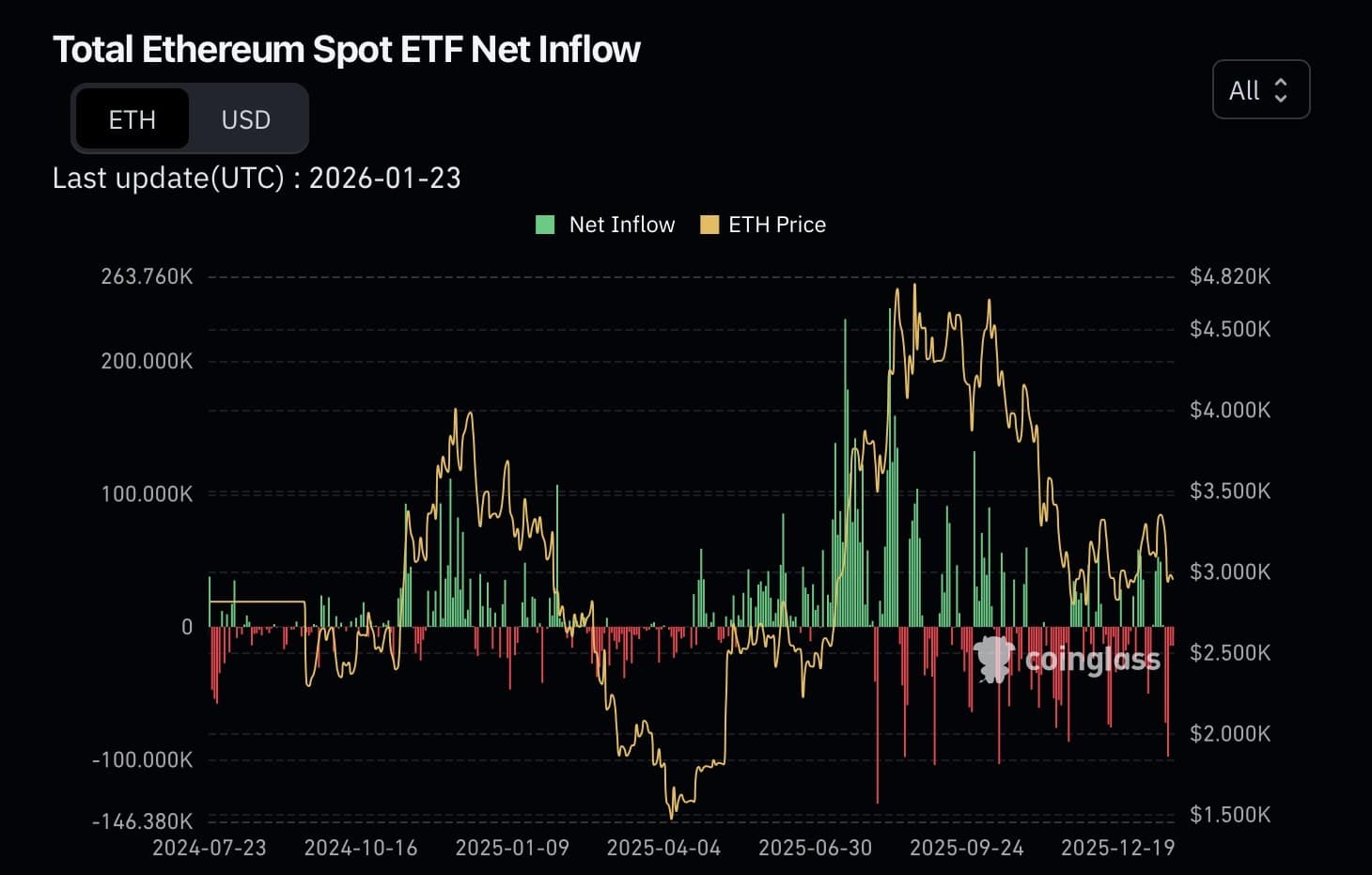

Ethereum Spot ETFs Outflows Spike as ETH Price Slumps

Ethereum spot ETFs are bleeding capital in the new year, with net outflows stacking up week after week. Total AUM (Assets Under Management) across the products hovers around $16–17 billion, a clear step down from end-of-2025 peaks as price action and redemptions both bite. The week of January 19–23 saw roughly $611 million exit the doors, one of the heavier prints recently.

Daily flows have stayed negative for multiple sessions running, with single-day outflows frequently landing in the $40–50 million range and occasional bigger hits topping $200–400 million from the largest issuers.

(Source: Coinglass)

We saw a similar pattern during recent Bitcoin ETF outflows, which added extra selling pressure.

Read the full story here.

SEC Filing Reveals Which Cryptos Wall Street Trusts Most

If crypto, at one point in time, attracts the billions often funneled to TradFi instruments like bonds, Bitcoin, Ethereum, and some of the best cryptos will easily bounce to 10X spot rates. It may take months, years, or even decades before that happens.

The good news is that there is concerted efforts to ensure there are secure bridges connecting TradFi and crypto. After all, pound-to-pound, crypto assets, including top Solana meme coins, tend to be more volatile. If volatility is what’s needed, then it can be tapped for massive gains. Bonds, for example, rarely move and are considered way safer than Bitcoin and other liquid assets.

THE SIGNAL EVERYONE IS IGNORING:

$8.8 BILLION just flooded into U.S. Treasuries in a single week the biggest wave since April.

Foreign capital is rushing back into American assets at full speed.

When global money positions this aggressively,

risk assets follow.If this much… pic.twitter.com/5cjNs4Kror

— Merlijn The Trader (@MerlijnTrader) November 21, 2025

Therefore, the recent SEC filing showing Cyber Hornet ETFs proposing an S&P-linked crypto ETF leaning heavily on Bitcoin, Ethereum, and XRP is precisely what every crypto enthusiast wants to watch. Even with this news, however, XRP and Ethereum remain under pressure. The XRP USD price, for example, is still below the $2 mark and under immense selling pressure. In the last week of trading, XRP crypto has lost nearly -5%.

Read the full story here.

The post Crypto Market News Today, January 26: Bitcoin, Ethereum, XRP, and Crypto Price Gravitating as USD Falls appeared first on 99Bitcoins.