When President Donald Trump acquires Greenland following this recent wave of Trump tariffs, every market is going to pump like crazy, and metals are going to correct significantly. Prepare wisely.

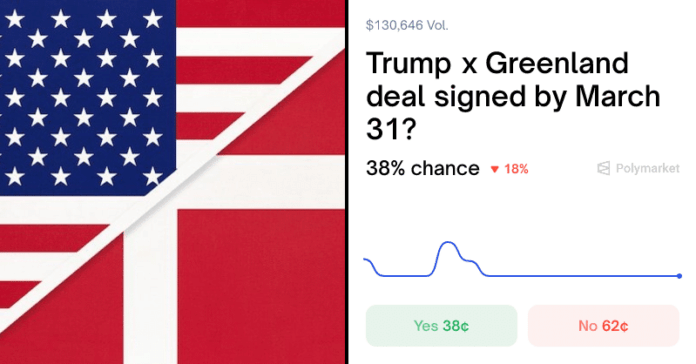

Polymarket, at least, gives this a 21-35% of happening:

The other side of the coin is that major parts of the Western world are removing their association with the USA right now because of Trump. This time, the US is targeting eight European countries, including England, Denmark and France, against US-Greenland acquisition efforts.

Our dollars are becoming increasingly worthless. Gold, silver, hard assets must go up as a result. So yes, Trump is adding volatility to the markets again, but at what cost?

DISCOVER: 20+ Next Crypto to Explode in 2025

What’s Unironically The Best way to Profit Off Of Trump Tariffs?

Invest in China? Short the S&P? It could all be this easy.

Equity futures slid across Europe and the US, while we have seen capital rush into traditional havens. Really, the big standout trade has been Gold and silver which punched through record highs.

Silver, specifically, is up 206% since this day last year.

Meanwhile, Trump’s tariff proposal is 10% tariff starting Feb. 1 on goods from Denmark, Norway, Sweden, France, Germany, the UK, the Netherlands, and Finland, escalating to 25% by June absent a deal on Greenland.

“The threat of tariffs against fellow NATO members adds a fresh dose of uncertainty,” – Tim Waterer, Chief Market Analyst, KCM Trade

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

What Will Perform Best Under Trump? Haven Assets Surge as ‘Sell America’ Rumors Return

Since the Trump tariffs, Gold jumped more than 1.5% to fresh records near $4,700 an ounce; silver surged past $94. European equity-index futures dropped about 1.3%, S&P 500 contracts fell near 1%, and the dollar softened against major peers.

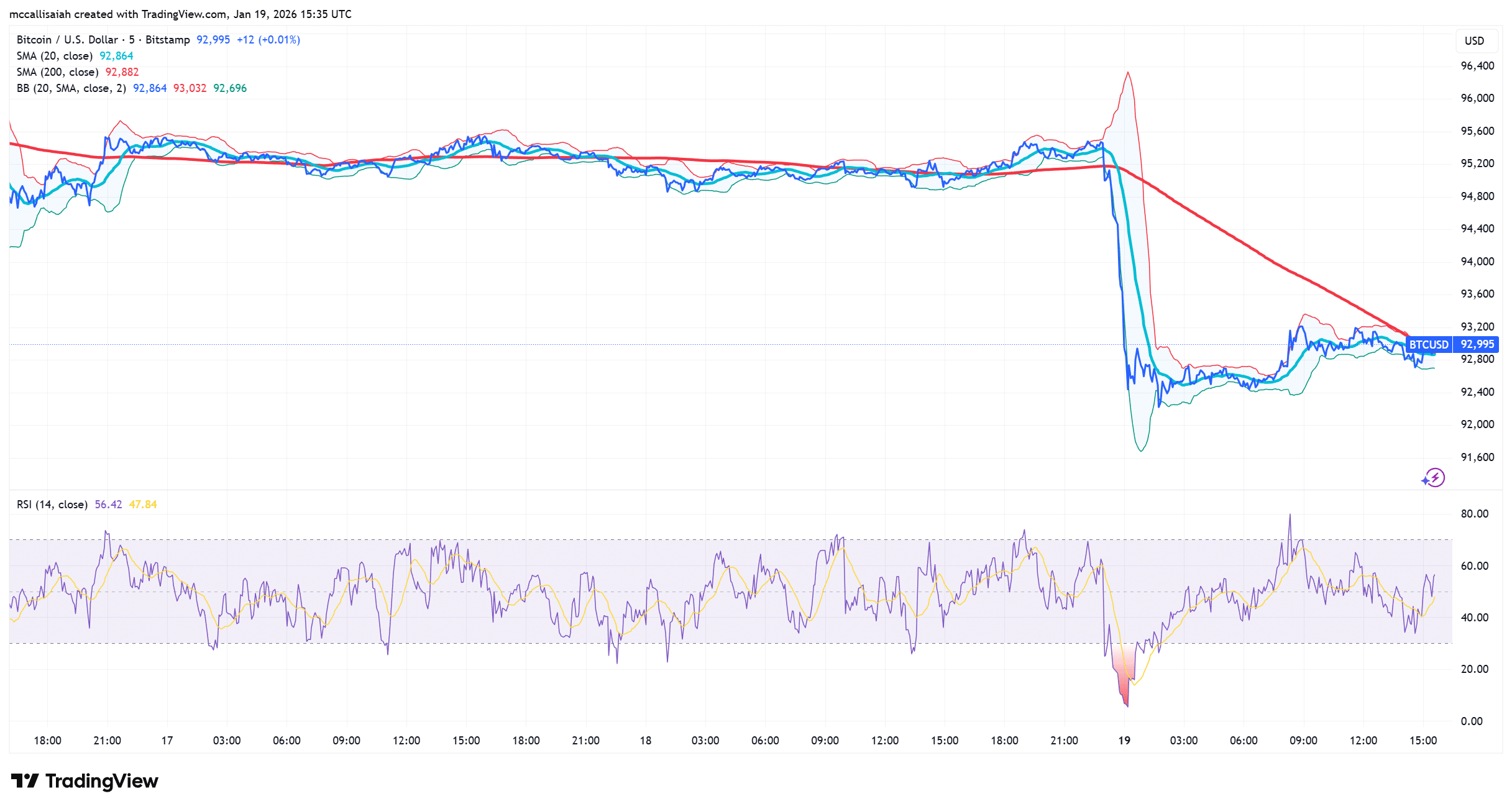

Bitcoin slipped as liquidity sought certainty over volatility:

- Gold: FRED data shows bullion up over 60% year-on-year, driven by rate-cut expectations and central-bank buying.

- Crypto: CoinGecko shows bitcoin retracing amid tariff headlines, consistent with short-term risk-off flows despite strong structural demand.

- Rates: Treasury futures gained on the holiday-thinned tape, while European bonds rallied.

European leaders rebuked the move, with France signaling possible activation of the EU’s anti-coercion instrument. A full trade war would be mutually destructive; Europe holds roughly $8T in US bonds and equities, nearly twice the rest of the world combined.

“There is no such thing as trade certainty anymore,” said Carsten Brzeski, Global Head of Macro, ING

Should You Sit On Your Hands Or Sell? (Our Honest Opinion)

Crypto Fear and Greed Chart

1y

1m

1w

24h

One bit of positive news: Asian markets have remained steady. South Korea rose on AI optimism; China hit its 5% growth target and the Japanese Yen/USD pairing has remained stable. The tension now is whether tariffs overwhelm earnings momentum or become another negotiating feint.

What we’ve seen in America is that capital itself has become the state.

Think feudal Japan: The president and his administration are the emperor, the Lord regent of the land whose word is an absolute and final mandate from heaven itself. The reality behind this surface-level fiction is that executives, firms, donors, and a very small elite of private interests dictate foreign and domestic policy in the same way the shogun had.

Trump can rattle the markets short-term, but he can’t derail the trajectory. Crypto, AI, and the S&P are all moving on fundamentals bigger than executive orders. The real catalyst is still loading: lower rates, QE. It’s not here yet, but it’s coming.

EXPLORE: King of The Decade? Analyst says Bitcoin Price Returns Will Beat Gold and Silver

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis

Key Takeaways

- When President Donald Trump acquires Greenland following this recent wave of Trump tariffs, every market is going to pump like crazy.

- The real catalyst is still loading: lower rates, QE. It’s not here yet, but it’s coming.

The post Trump Tariffs: WTF is Wrong With Americans And What to Buy? appeared first on 99Bitcoins.